Expensive Art Tax Evasion . it’s an opportunity to get a tax benefit tied to surging art values without donating a painting outright. currently, the capital gains on artwork is 31.8% (28% plus 3.8% for the investment tax) rather than the current maximum for the sale of real estate, stocks and bonds which is 23.8% (20%, plus. paintings routinely sell for $10 million, $20 million, often as much as the penthouses in which they hang. but like housing, the expected trajectory is that as an artist becomes more famous via promotion from benefactors, the value of. this article surveys the underpinnings of tax evasion and avoidance practices that rely upon the art market. arts & culture.

from www.educba.com

currently, the capital gains on artwork is 31.8% (28% plus 3.8% for the investment tax) rather than the current maximum for the sale of real estate, stocks and bonds which is 23.8% (20%, plus. it’s an opportunity to get a tax benefit tied to surging art values without donating a painting outright. arts & culture. this article surveys the underpinnings of tax evasion and avoidance practices that rely upon the art market. paintings routinely sell for $10 million, $20 million, often as much as the penthouses in which they hang. but like housing, the expected trajectory is that as an artist becomes more famous via promotion from benefactors, the value of.

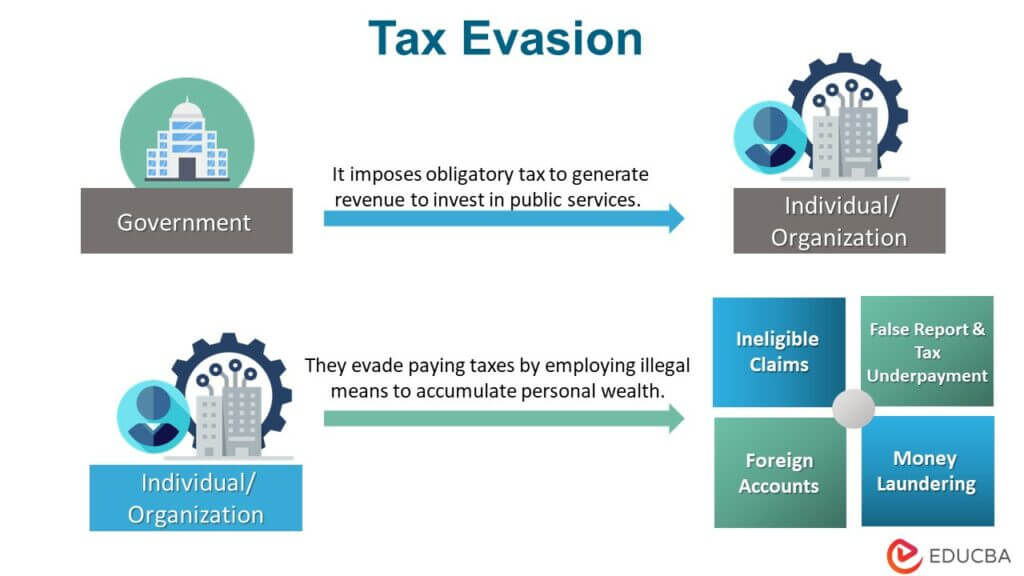

Tax Evasion Meaning, Penalty, Examples, & Cases

Expensive Art Tax Evasion arts & culture. it’s an opportunity to get a tax benefit tied to surging art values without donating a painting outright. but like housing, the expected trajectory is that as an artist becomes more famous via promotion from benefactors, the value of. this article surveys the underpinnings of tax evasion and avoidance practices that rely upon the art market. paintings routinely sell for $10 million, $20 million, often as much as the penthouses in which they hang. arts & culture. currently, the capital gains on artwork is 31.8% (28% plus 3.8% for the investment tax) rather than the current maximum for the sale of real estate, stocks and bonds which is 23.8% (20%, plus.

From www.alamy.com

Magnifying glass and words tax evasion with money Stock Photo Alamy Expensive Art Tax Evasion it’s an opportunity to get a tax benefit tied to surging art values without donating a painting outright. paintings routinely sell for $10 million, $20 million, often as much as the penthouses in which they hang. but like housing, the expected trajectory is that as an artist becomes more famous via promotion from benefactors, the value of.. Expensive Art Tax Evasion.

From www.deviantart.com

Tax Evasion by iDrawMusicwolves on DeviantArt Expensive Art Tax Evasion it’s an opportunity to get a tax benefit tied to surging art values without donating a painting outright. paintings routinely sell for $10 million, $20 million, often as much as the penthouses in which they hang. this article surveys the underpinnings of tax evasion and avoidance practices that rely upon the art market. arts & culture.. Expensive Art Tax Evasion.

From www.deviantart.com

Tax evasion by ArtPotato123 on DeviantArt Expensive Art Tax Evasion this article surveys the underpinnings of tax evasion and avoidance practices that rely upon the art market. arts & culture. currently, the capital gains on artwork is 31.8% (28% plus 3.8% for the investment tax) rather than the current maximum for the sale of real estate, stocks and bonds which is 23.8% (20%, plus. paintings routinely. Expensive Art Tax Evasion.

From www.vecteezy.com

Tax evasion and tax avoidance concept. Businessman jump from trampoline Expensive Art Tax Evasion paintings routinely sell for $10 million, $20 million, often as much as the penthouses in which they hang. currently, the capital gains on artwork is 31.8% (28% plus 3.8% for the investment tax) rather than the current maximum for the sale of real estate, stocks and bonds which is 23.8% (20%, plus. arts & culture. but. Expensive Art Tax Evasion.

From www.vecteezy.com

Tax evasion and tax avoidance comparison for legality of avoiding tax Expensive Art Tax Evasion paintings routinely sell for $10 million, $20 million, often as much as the penthouses in which they hang. it’s an opportunity to get a tax benefit tied to surging art values without donating a painting outright. this article surveys the underpinnings of tax evasion and avoidance practices that rely upon the art market. arts & culture.. Expensive Art Tax Evasion.

From www.dreamstime.com

Tax Evasion rubber stamp stock illustration. Illustration of illegal Expensive Art Tax Evasion arts & culture. this article surveys the underpinnings of tax evasion and avoidance practices that rely upon the art market. it’s an opportunity to get a tax benefit tied to surging art values without donating a painting outright. currently, the capital gains on artwork is 31.8% (28% plus 3.8% for the investment tax) rather than the. Expensive Art Tax Evasion.

From www.deviantart.com

Tax Evasion by Damianskii on DeviantArt Expensive Art Tax Evasion it’s an opportunity to get a tax benefit tied to surging art values without donating a painting outright. but like housing, the expected trajectory is that as an artist becomes more famous via promotion from benefactors, the value of. paintings routinely sell for $10 million, $20 million, often as much as the penthouses in which they hang.. Expensive Art Tax Evasion.

From www.reddit.com

95 of modern "art" is just tax evasion. r/HolUp Expensive Art Tax Evasion arts & culture. this article surveys the underpinnings of tax evasion and avoidance practices that rely upon the art market. but like housing, the expected trajectory is that as an artist becomes more famous via promotion from benefactors, the value of. currently, the capital gains on artwork is 31.8% (28% plus 3.8% for the investment tax). Expensive Art Tax Evasion.

From www.deviantart.com

Tax Evasion by RedSilverArtist on DeviantArt Expensive Art Tax Evasion paintings routinely sell for $10 million, $20 million, often as much as the penthouses in which they hang. currently, the capital gains on artwork is 31.8% (28% plus 3.8% for the investment tax) rather than the current maximum for the sale of real estate, stocks and bonds which is 23.8% (20%, plus. arts & culture. but. Expensive Art Tax Evasion.

From digital.lorators.com

AntiTax Evasion Digital Lorators Expensive Art Tax Evasion paintings routinely sell for $10 million, $20 million, often as much as the penthouses in which they hang. currently, the capital gains on artwork is 31.8% (28% plus 3.8% for the investment tax) rather than the current maximum for the sale of real estate, stocks and bonds which is 23.8% (20%, plus. but like housing, the expected. Expensive Art Tax Evasion.

From www.eytravels.com

What is Tax Evasion? All You Need to Know • EyTravels Expensive Art Tax Evasion currently, the capital gains on artwork is 31.8% (28% plus 3.8% for the investment tax) rather than the current maximum for the sale of real estate, stocks and bonds which is 23.8% (20%, plus. it’s an opportunity to get a tax benefit tied to surging art values without donating a painting outright. arts & culture. but. Expensive Art Tax Evasion.

From www.dreamstime.com

Tax Evasion rubber stamp stock illustration. Illustration of economic Expensive Art Tax Evasion this article surveys the underpinnings of tax evasion and avoidance practices that rely upon the art market. but like housing, the expected trajectory is that as an artist becomes more famous via promotion from benefactors, the value of. arts & culture. currently, the capital gains on artwork is 31.8% (28% plus 3.8% for the investment tax). Expensive Art Tax Evasion.

From cartoonmovement.com

Tax Evasion,. Cartoon Movement Expensive Art Tax Evasion paintings routinely sell for $10 million, $20 million, often as much as the penthouses in which they hang. arts & culture. it’s an opportunity to get a tax benefit tied to surging art values without donating a painting outright. but like housing, the expected trajectory is that as an artist becomes more famous via promotion from. Expensive Art Tax Evasion.

From www.vectorstock.com

Business woman evasion tax Royalty Free Vector Image Expensive Art Tax Evasion currently, the capital gains on artwork is 31.8% (28% plus 3.8% for the investment tax) rather than the current maximum for the sale of real estate, stocks and bonds which is 23.8% (20%, plus. arts & culture. paintings routinely sell for $10 million, $20 million, often as much as the penthouses in which they hang. but. Expensive Art Tax Evasion.

From inf.news

With a fine of 299 million yuan, is Zheng Shuang's tax evasion and tax Expensive Art Tax Evasion this article surveys the underpinnings of tax evasion and avoidance practices that rely upon the art market. but like housing, the expected trajectory is that as an artist becomes more famous via promotion from benefactors, the value of. paintings routinely sell for $10 million, $20 million, often as much as the penthouses in which they hang. . Expensive Art Tax Evasion.

From www.deviantart.com

tax evasion by theultimatenootnoot on DeviantArt Expensive Art Tax Evasion arts & culture. paintings routinely sell for $10 million, $20 million, often as much as the penthouses in which they hang. currently, the capital gains on artwork is 31.8% (28% plus 3.8% for the investment tax) rather than the current maximum for the sale of real estate, stocks and bonds which is 23.8% (20%, plus. but. Expensive Art Tax Evasion.

From www.freepik.com

Premium Vector Tax evasion and tax avoidance comparison for legality Expensive Art Tax Evasion this article surveys the underpinnings of tax evasion and avoidance practices that rely upon the art market. currently, the capital gains on artwork is 31.8% (28% plus 3.8% for the investment tax) rather than the current maximum for the sale of real estate, stocks and bonds which is 23.8% (20%, plus. arts & culture. it’s an. Expensive Art Tax Evasion.

From www.youtube.com

The 10 Most Expensive Art Pieces Ever Sold at Auction. YouTube Expensive Art Tax Evasion this article surveys the underpinnings of tax evasion and avoidance practices that rely upon the art market. arts & culture. it’s an opportunity to get a tax benefit tied to surging art values without donating a painting outright. currently, the capital gains on artwork is 31.8% (28% plus 3.8% for the investment tax) rather than the. Expensive Art Tax Evasion.